Chapter 7

Chapter 13

Testimonials

“I very highly recommend Jennifer Johnson if you are looking for an attorney for bankruptcy. She and her staff are very professional. She is such an awesome attorney, she is so kind and helpful. Really no words can describe how thankful I am to her for taking my case.”

-Mr. J

“Jon was very professional with helping me through a difficult decision. He laid out all my options and discussed in detail each one. I am thankful for his service and guidance.

-Mr. C

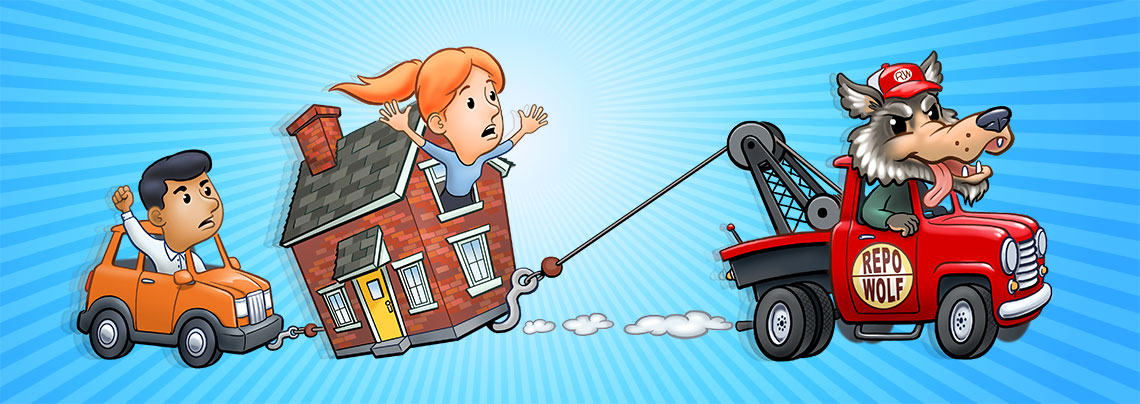

Chapter 7 Bankruptcy and Foreclosure

As a homeowner, it’s important to choose the best option for your situation.

If you are facing foreclosure, Chapter 7 may not be the best alternative if you intend to save your home. See our Chapter 13 page for more details. After filing for Chapter 7 bankruptcy, a bankruptcy estate is created. This bankruptcy estate will include almost all of your assets, which includes your home. A Chapter 7 bankruptcy trustee will be authorized to liquidate your non-exempt assets and distribute the proceeds to your secured creditors first, such as your home mortgage lender. After proceeds have been distributed to secured creditors, anything left will go to your general unsecured creditors, such as credit card companies. If you file for Chapter 7 bankruptcy and wish to keep your home, your ability to do so will depend primarily on the amount of the homestead exemption available to you as well as how much equity you have in your home. If you were facing foreclosure before filing Chapter 7 and the Trustee elects to not sell your house, you will still be facing foreclosure and be behind on your mortgage when it is finished. There are forms of bankruptcy more suited to someone facing foreclosure, namely Chapter 13.

Equity and Exemptions

Your bankruptcy trustee will not sell a home that has no equity. If the balance of a mortgage is greater than the value of the home, this means there is no equity. A bankruptcy trustee may abandon a home if he or she determines that selling it would not bring in enough proceeds to distribute to your unsecured creditors after the secured mortgage and your homestead exemption is paid.

However, if your home has equity, the trustee can sell it unless you are able to exempt the equity. You can do this using the Tennessee Homestead Exemption. The homestead exemption is applicable to real property you own and use as your principal place of residence. In the State of Tennessee, the homestead exemption amount you are allowed to take depends on your marital status, your age, your spouse’s age, and if you have minor children in your home.

The homestead exemption allows you to exempt up to $5,000 worth of property if single, no minor children, and under age 62. Married couples can exempt up to $7,500 where they have no minor children in the household and are under age 62. A single person age 62 or older can exempt up to $12,500. A married couple, one of whom is 62 years or older can exempt up to $20,000. A married couple, both of whom are 62 or older can exempt up to $25,000. Anyone who has one or more minor children as dependents in his or her household may exempt up to $25,000 on property owned and used as a principal place of residence. The minor child exemption applies to each person so a married couple with a minor child in the household can exempt up to $50,000. For more information regarding the homestead exemption in Chapter 7 bankruptcy, consult an experienced Nashville bankruptcy attorney.

If you end up with a small amount of non-exempt equity in your home, it is possible that a bankruptcy trustee may still abandon it if there would not be enough proceeds left over to distribute to creditors. If your home is not abandoned by the bankruptcy trustee, you may be able to pay an amount equal to the non-exempt portion of the equity or even exchange another one of your assets in order to keep your home.

If you are able to keep your home, your personal liability on the mortgage will be wiped out when you receive your Chapter 7 discharge. It is important to note that your mortgage lender will still have a lien on your home, which cannot be discharged. Your lender may still proceed with foreclosure if you fall behind on your mortgage payments. If you wish to keep your home, you must continue making your mortgage payments during and after your bankruptcy.