Chapter 7

Chapter 13

Testimonials

“Since I had no real clue on what to deal with regarding bankruptcy, Jennifer was awesome in helping me on the correct path to take. Once I gave her all that information requested it was easy. I will say it was a huge relief when I left the office knowing she will handle everything. I would totally recommend this group to anyone. Thank you very much!

-Mr. S

“Working with Mr. Long was the best experience when filing my bankruptcy. Bankruptcy can be an intimidating process but Mr. Long eased all of the fears that I had. He was very thorough in explaining my options and guiding me to what he felt would be the best option for me. Any one looking for a good bankruptcy lawyer I would definitely recommend his firm.”

-Ms. R

Chapter 13 or Chapter 7 Bankruptcy?

Long, Burnett, and Johnson can help you choose the best option for you.

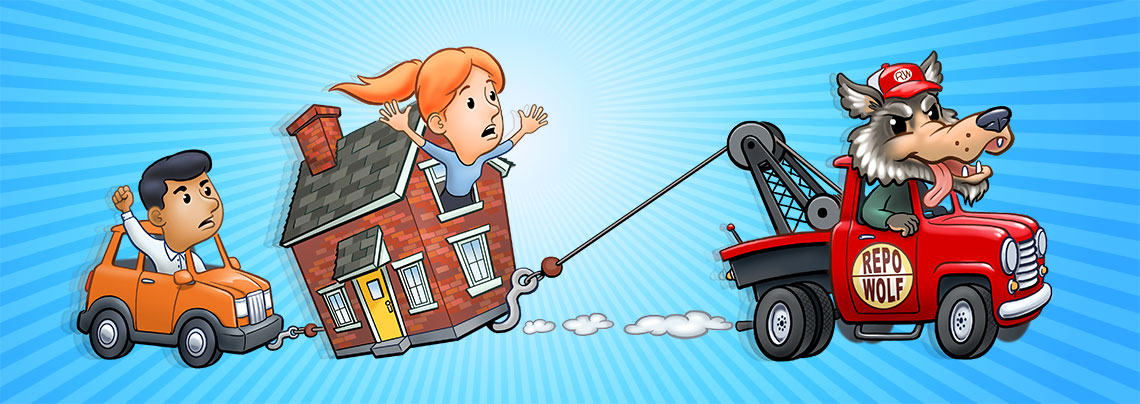

When an individual or business is experiencing harassment from creditors and collection agencies due to overwhelming debt, bankruptcy may be the most viable option. However, Chapter 13 bankruptcy and Chapter 7 bankruptcy provide two very different strategies for dealing with debts. Hiring an experienced bankruptcy lawyer is imperative in order to choose the best course of action for your circumstances.

When Chapter 13 Bankruptcy may be better than Chapter 7

Chapter 13 bankruptcy may be a more viable option for some debtors. Sometimes a debtor does not qualify for Chapter 7 bankruptcy. Not qualifying for Chapter 7 bankruptcy occurs when the debtor’s income is sufficient to allow at least a partial payment of their unsecured debts such as credit cards and medical bills. Even when a debtor qualifies for Chapter 7, Chapter 13 may be a better option.

Circumstances in which Chapter 13 bankruptcy may be a better option include:

- When a debtor is behind on a car loan or mortgage

- The debtor has debts that are not dischargeable in Chapter 7 bankruptcy. Such debts might include tax obligations and obligations to a former spouse

- The debtor has a sincere desire to pay off their debts, but needs the protection of the bankruptcy court to do so

- The debtor has nonexempt property that he or she wishes to keep

- The debtor has a codebtor on a personal debt

Filing for Chapter 13 bankruptcy allows you to keep all wanted possessions as you repay your debts through a management plan that you and your attorney devise. In keeping up with the payment plan, the debtor has the possibility of ending their bankruptcy period free from debt and able to make a fresh financial start.

Contact Us

If you are overwhelmed with debt and not sure how best to handle your situation, you need the guidance of a bankruptcy lawyer. Your bankruptcy lawyer will review your financial circumstances and help to devise a manageable payment plan to get you out of debt as quickly and efficiently as possible.